Personal information security is a hot topic these days. Between news of identity theft, mass data breaches and social media personal data security, the subject is front and center in our minds. We all want out personal information to be safe, whether it is our financial information, medical records, or social media data. Each year, we handle hundreds of documents that entail sensitive information, physical paper, our personal and financial paperwork.

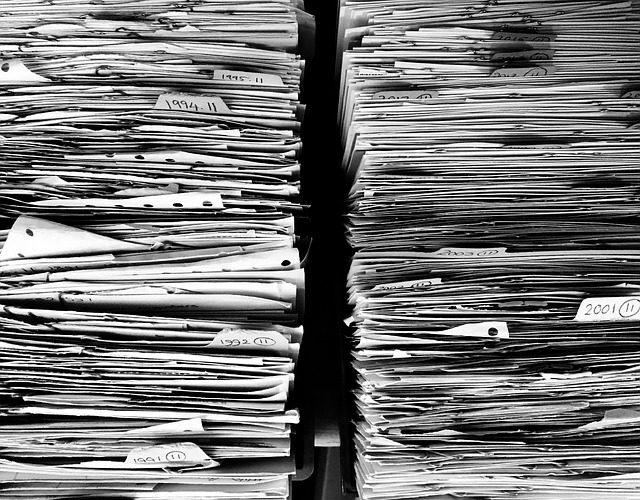

It can be confusing to figure out what documents we need to keep, how long, and what documents we can dispose of, and how. Some individuals are so anxious about identity theft that they do not dispose of any paperwork at all! That results in massive paper piles, making it nearly impossible to find important documents when you need them. These piles can become an overwhelming burden. Paperwork clutter is a common problem, and very tedious and time consuming to tackle.

So, how can we protect our personal information (without getting buried in paper), at least the kind of personal information which commonly arrives in the mail? What to keep? How long? Why? We have some answers for you.

What Personal Information to Keep and How Long

- Tax Returns: Keep copies of all your tax returns. Keep the back-up information and receipts for the last 7 years of returns. Shred the back up information for the older tax returns.

- Pay Stubs: Keep them for the current year, reconcile with your W-2, then shred.

- Credit card and bank statements: Should be kept for 3 years unless they a key component in your 7 years of tax receipts. If you still receive bank account statement in the mail, consider switching to online – you’ll have the records you need without the paper clutter. Shred old credit card and bank statements.

- Financial Brokerage accounts: Keep the current year statements. At the end of year, save only year-end and tax related forms. Then shred the monthly or quarterly statements.

- Trade Confirmations: Hang on to trade confirmations which show the original price of stocks when purchased. Keep trade confirmations in a labeled manila folder with your tax receipts.

- Medical and Dental Documents: Keep all medical billing statements and prescription receipts for the current year. (If you incur large medical expenses for the year, you may be to claim a tax deduction. The IRS allows you to count medical expenses exceeding 10% of your adjusted gross income in your itemized tax deductions.) Shred all your medical billing statements and EOB’s at the end of the year if you didn’t meet the medical claim amount for your income. Keep documents that could be useful as a part of your medical history.

- Utility Statements: Keep two months of utility statements. Keep all utility statements if you have a home business and are writing off a portion of those expenses to your business. Shred old utility statements.

- Home Improvement Receipts: If you believe you will be doing a wealth of home improvements, materially raising the value of your home, keep all home improvement receipts for potential capital gains tax when you sell the home.

- Keep Forever: Keep your current insurance policies, wills, living wills, and powers of attorney, titles to the vehicles you currently own, active loan papers, deeds and mortgage documents for your home. Store in a safe location.

What Personal Information to Shred

Shred anything that has account numbers, social security number or personal information you wouldn’t want a stranger to see. Better safe than sorry. If the idea of wading through your paperwork makes you cringe, give us a call, we love organizing paper, and we’ll haul away and dispose of your shredding safely.

—

Disclaimer: Simplify Experts, LLC and its employees are not tax professionals. If you should have any specific tax related questions, please consult your tax professional.