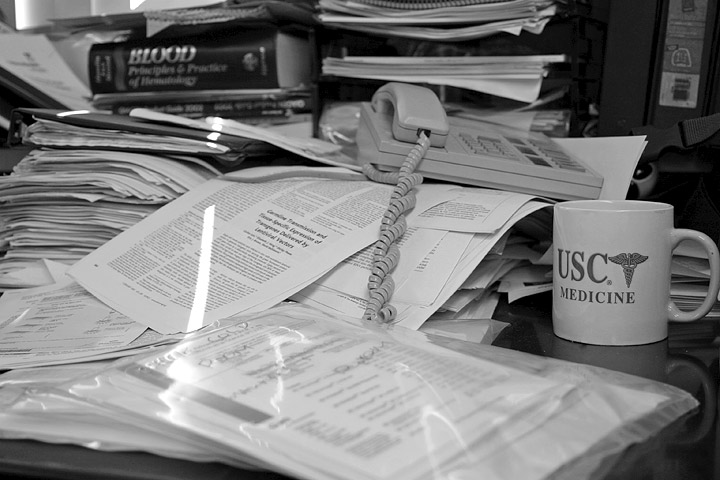

Paperwork

Get Started On Your Taxes Now

The deadline to file your 2023 taxes is midnight on Monday, April 15, 2024. That date will be here faster than you think. Don’t hold off any longer—the time to

The deadline to file your 2023 taxes is midnight on Monday, April 15, 2024. That date will be here faster than you think. Don’t hold off any longer—the time to

Unless you are an accountant, for many of us, filing our tax returns ranks on the list of fun activities right next to root canals. Some of us get through

The deadline to file your taxes will arrive sooner than you think. It may feel like a long time from now, but the time to file is as soon as