Even though we are in the Digital Age, paper remains a constant in our lives. While junk emails have replaced junk snail mail (trees happy, inboxes…not so much), one of the major paper generators of all is personal finances. Last summer my husband and I sold and then bought a home—the amount of paper those two transactions took was mind-boggling. We all have bank records, loans, credit cards, and utilities…and that is just the beginning. So much of our money-related information enters our homes as paper! Organizing paperwork can definitely be overwhelming. Let these guidelines help you get your financial documents in order.

Review what documents you have.

Before you can organize your documents, go through them and see what you have. Organize them into categories, such as To File, To Shred, To Read, To Pay, and Needs Action. You may discover unpaid bills, receipts for tax deductions, and all sorts of other paperwork you didn’t realize was in that big stack. If you’re uncertain about what to keep and what to shred, refer to our thorough guide on paper retention.

Set up a filing system.

Set up a filing system.

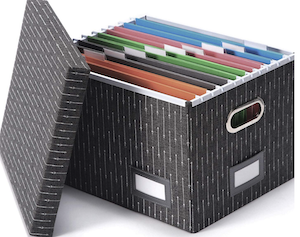

Whether you use a file box or a cabinet, you will also need plenty of file folders and labels for all your documents. Create file folders for specific categories, with a file for each account under one category.

Some examples:

- Auto – Car titles, autopay enrollments, documentation

- Bank accounts – Account information, reconciled statements

- Credit cards – Statements, benefits and rewards programs documents, receipts

- Education expenses – College funds, FAFSA documents, loan documents

- Financial services – Statements, correspondence, fee tables

- Insurance – Policies, statements, claims

- Investments – Pension plans, retirement plans, 401k and IRA accounts, stocks

- Loans – Home, auto, and personal loans and statements

- Medical – Statements from health providers, insurance cards and statements, receipts

- Tax related – W-2’s, 1099’s, deductions, charity and donation receipts

- Utilities – Energy, water/sewage, phone, cable, etc.

- Estate plans and wills – Current estate plans/wills, list of all financial accounts and contact information, lawyers’ names and contact info

“To do” folders you should have:

To Pay is for bills that you need to pay by check or online. Once it’s paid, note on the invoice your method of payment, the date, and any kind of confirmation or authorization number. Then file it.

To Read is for paperwork you need to read, and may be filed or shredded once you’ve finished.

Needs Action is for documents that require you do something more, such as contacting a credit card company or claims department. Once you’ve resolved the issue and no more action is needed, note down on the document the date and the resolution, then file accordingly.

Are there documents that can go digital?

After you’ve sorted through and filed your documents, consider accounts that could go digital. You can really trim down the incoming paper you need to deal with! For instance, all of our utilities are billed by email and paid online on our Visa card (Hey, those points add up!). A few, such as cell phone and streaming services, are on autopay. The only documents in our utilities folders are the initial statement of starting service, any change in service notices, and invoices that had once needed action. Otherwise, the billing and payment history of those accounts is available when I login to them.

Keep on top of it.

Once a week set aside an hour to go through the To Pay, To Read, and Needs Action folders. Sometimes it will take you 15 minutes to finish everything; sometimes the whole hour. Then once a month go through the To File and To Shred folders, and get those documents appropriately filed away or shredded. Even if you’re not a secret agent, your private documents (plus CDs, DVDs, and old credit cards) should be properly destroyed to minimize identity theft. A more secure micro-cut shredder is a worthy investment.

Each household’s financial documents will definitely have a different set of categories for their filing system. I can recall the small file box I used in my 20’s, as opposed to my current file cabinet. Your finances generally get more vast and complicated as you get older! One of the sweetest advantages to having your financial paperwork organized is being able to find what you need a LOT faster—no more rifling through stacks of cluttered documents. It can also be rather overwhelming. If you’re not sure where to begin, don’t hesitate to ask for help. Our complimentary one-hour consultation is just a phone call or email away.